The Impact of the B-20 Stress Test on BC Home Sales in 2018

To view the Market Intelligence Report PDF, click here.

Summary Findings:

- The decline in home sales in 2018 was largely due to market factors like interest rates and affordability

- Without the stress test, home sales in BC would have been about 7,500 sales—or 10% higher—in 2018

- Approximately $500 million in BC economic activity was lost due the B20 stress test

Home sales across Canada plummeted to

start 2018. The near-coincident

implementation of several new federal and

provincial housing policies designed to temper

BC housing demand has given rise to

competing explanations for what ultimately

caused the downturn. Was it the B20

mortgage stress test? Higher interest rates?

The provincial speculation tax or the

expansion of the foreign buyers’ tax?

Home sales across Canada plummeted to

start 2018. The near-coincident

implementation of several new federal and

provincial housing policies designed to temper

BC housing demand has given rise to

competing explanations for what ultimately

caused the downturn. Was it the B20

mortgage stress test? Higher interest rates?

The provincial speculation tax or the

expansion of the foreign buyers’ tax?

In this Market Intelligence, we will attempt to provide some insight into the causes of the 2018 housing market slowdown.

Isolating the Impact of the B20 Mortgage

Stress Test

Isolating the Impact of the B20 Mortgage

Stress Test

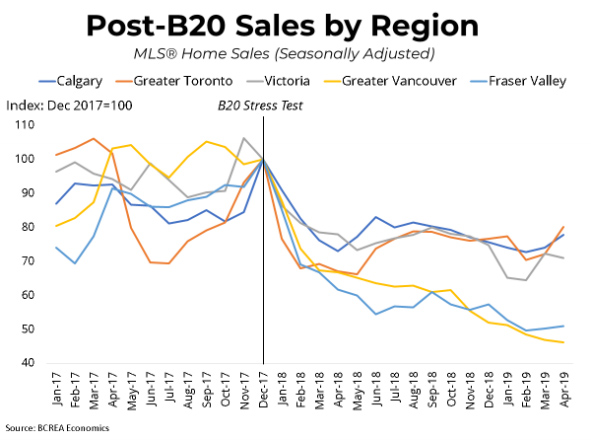

The coordinated decline in Canadian home

sales, which began immediately after the

implementation of B20, makes that policy a

natural place to look as we investigate the

cause of the housing downturn. The fact that

so many Canadian markets saw home sales

drop sharply to start 2018 indicates a

common factor driving that decline.

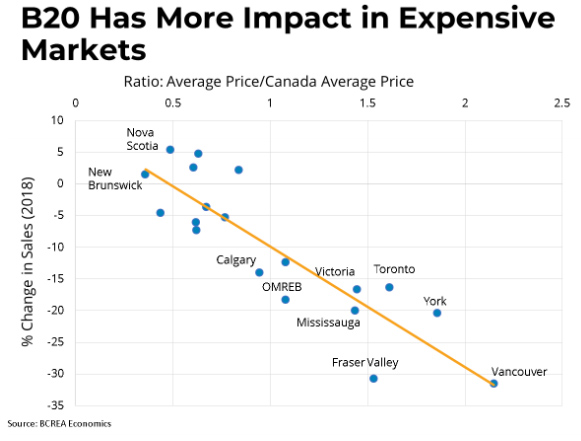

Many markets in BC experienced a much deeper and more prolonged decline in home sales than in other Canadian markets, perhaps pointing to provincial polices weighing down sales over and above the impact of the stress test alone. However, when we look at markets across Canada, it appears that the outsized decline in BC may have more to do with relatively stretched affordability in BC compared to the rest of the country. Expensive markets in other areas, most notably those near Toronto, also experienced significant declines in 2018.

Methodology

Methodology

The ideal way to identify causation in

economics is to use a controlled

experiment, in which impacts can be

compared between a test group subject to

the new policy and a control group that is

not. Unfortunately, such experiments in

macroeconomics are rare. Since B20

applies across all Canadian market

s, we

do not have a suitable control group to use

as a baseline for comparison. As a next

best solution, we can instead use

econometric modelling to estimate a

baseline of home sales if the stress test

had not been implemented.

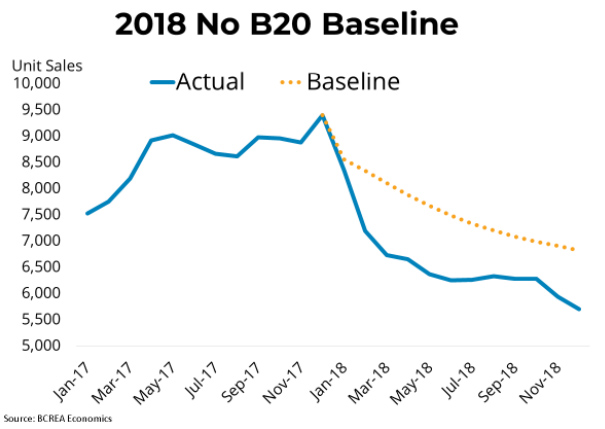

Using BCREA’s workhorse forecasting

modeli, we estimate a 2018 baseline of BC home

sales of 90,500 units, a decline of roughly 13,000 units from 2017. This decline was drivenby market forces such as rising interest rates,

deteriorating affordability and a slowing

economy. Given that home sales in 2018 were

78,346, this means that factors outside of those

explicitly controlled for in the model need to

explain about 12,000 additional lost sales.

Isolating the share of sales lost due to the stress

test is a challenging task. To do so,

we employed both our own forecasting model

and a model of sales fundamentals

developed by the Bank of Canadaii.

Using BCREA’s workhorse forecasting

modeli, we estimate a 2018 baseline of BC home

sales of 90,500 units, a decline of roughly 13,000 units from 2017. This decline was drivenby market forces such as rising interest rates,

deteriorating affordability and a slowing

economy. Given that home sales in 2018 were

78,346, this means that factors outside of those

explicitly controlled for in the model need to

explain about 12,000 additional lost sales.

Isolating the share of sales lost due to the stress

test is a challenging task. To do so,

we employed both our own forecasting model

and a model of sales fundamentals

developed by the Bank of Canadaii.

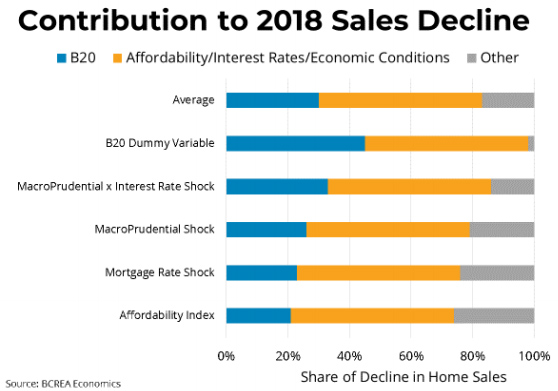

Specifically, we tried to isolate the impact of the

stress test using 5 different shock specifications.

These include incorporating B20 as a shock to

an affordability index, a shock to the cost of

borrowing, a policy dummy variable and a shock

to a macroprudential policy indexiii both by itself

and interacted with mortgage ratesiv

. We then

compared dynamic simulations from these

models to our estimated baseline.

Specifically, we tried to isolate the impact of the

stress test using 5 different shock specifications.

These include incorporating B20 as a shock to

an affordability index, a shock to the cost of

borrowing, a policy dummy variable and a shock

to a macroprudential policy indexiii both by itself

and interacted with mortgage ratesiv

. We then

compared dynamic simulations from these

models to our estimated baseline.

We estimate the lost sales due to B20 in 2018 to be a range of 5,300 to 11,500 units, with an average of 7,500 units. On average, we estimate that B20 accounted for about 30% of the total downturn in BC home sales observed in 2018 and cost the province approximately $500 million in spin-off activity related to MLS® home sales v

Notes and References:

i BCREA’s workhorse forecasting model uses a vector error-correction framework in which sales, listings and prices are determined jointly based on a long-run equilibrium relationship and changes in other factors such as interest rates and employment growth.

ii Taylor Webley, “Fundamental Drivers of Existing Home Sales in Canada,” Bank of Canada Staff Discussion Paper, December 2018.

iii This index was constructed based on the IMF’s integrated Macroprudential Policy (iMaPP) database, found here.

iv The methodology here is similar to Aastveit et al., “Economic uncertainty and the effectiveness of monetary policy,” Norges Bank Research Working Paper, June 2013.

v Lost economic activity is derived from estimates of spin-off activity resulting from each MLS sale, found here.

For more information, please contact:

Brendon Ogmundson

Deputy Chief Economist

Direct: 604.742.2796

Mobile: 604.505.6793

[email protected]

Kellie Fong

Economist

Direct: 778.357.0831

Mobile: 604-366-6511

[email protected]

To subscribe to receive BCREA publications such as this one, or to update your email address or current subscriptions, click here.

What we do

Popular tags within Economics

- COVID-19

- Statistical Releases

- Mortgages

- Professional Development Program

- Housing Affordability

- Housing Supply

Popular posts from BCREA

-

Housing Market Update – April 2024Apr 17, 2024

-

Mortgage Rate ForecastMar 25, 2024