Commercial Leading Indicator Jumps in Fourth Quarter 2023

To view the full Commercial Leading Indicator PDF, click here.

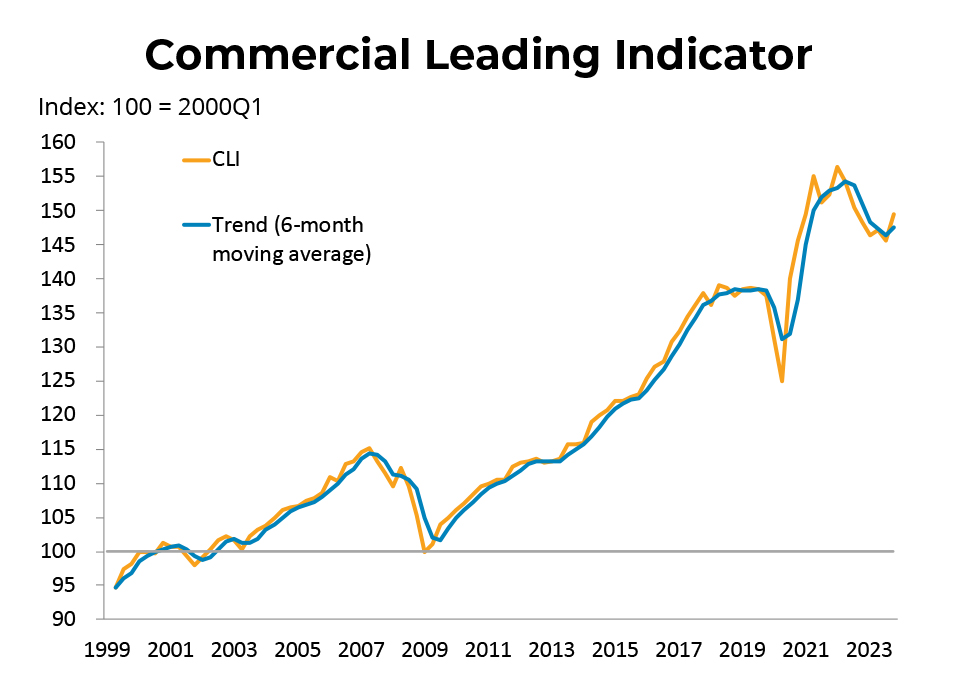

The BCREA Commercial Leading Indicator (CLI) rose 3.8 points to 149.5 in the fourth quarter of 2023, while the six-month moving average rose to 147.4. Compared to the same quarter in 2022, the index was up by 0.8 per cent.

Fourth Quarter Highlights

- The economic activity index rose in Q4. Inflation-adjusted retail trade, wholesale trade, and manufacturing sales rose, pushing the economic component upwards.

- Office employment (financial, insurance, real estate, and professional services) fell by 0.6 per cent in the fourth quarter, but manufacturing employment more than offset the decline with a 4.2 per cent increase. On net, the employment component contributed positively to the index.

- The financial component of the index rose in the fourth quarter. Rising Real Estate Investment Trust prices pushed the financial component upwards. In addition, falling interest rate spreads, which indicate higher borrowing costs for companies relative to the government, further contributed to the rise in the financial component.

To subscribe to BCREA news releases by email please click here.

Send questions and comments about Commercial Leading Indicator to:

Ryan McLaughlin

Chief Economist

[email protected]

604.366.6511

To subscribe to receive BCREA publications such as this one, or to update your email address or current subscriptions, click here.

What we do

Popular tags within Economics

- COVID-19

- Statistical Releases

- Mortgages

- Professional Development Program

- Housing Affordability

- Housing Supply

Popular posts from BCREA

-

Housing Market Update – April 2024Apr 17, 2024

-

Mortgage Rate ForecastMar 25, 2024