For the complete news release, including detailed statistics, click here.

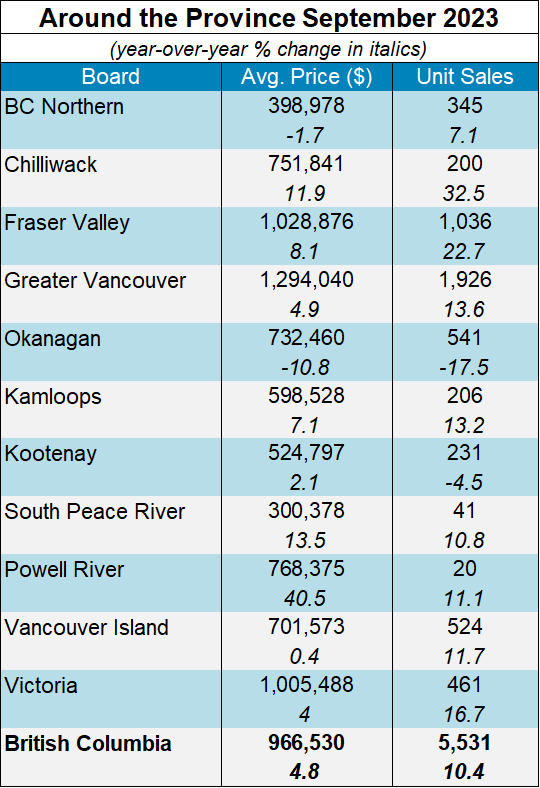

Vancouver, BC – October 12, 2023. The British Columbia Real Estate Association (BCREA) reports that a total of 5,531 residential unit sales were recorded in Multiple Listing Service® (MLS®) systems in September 2023, an increase of 10.4 per cent from September 2022. The average MLS® residential price in BC was $966,530 up 4.8 per cent compared to September 2022. The total sales dollar volume was $5.3 billion, representing a 15.7 per cent increase from the same time last year.

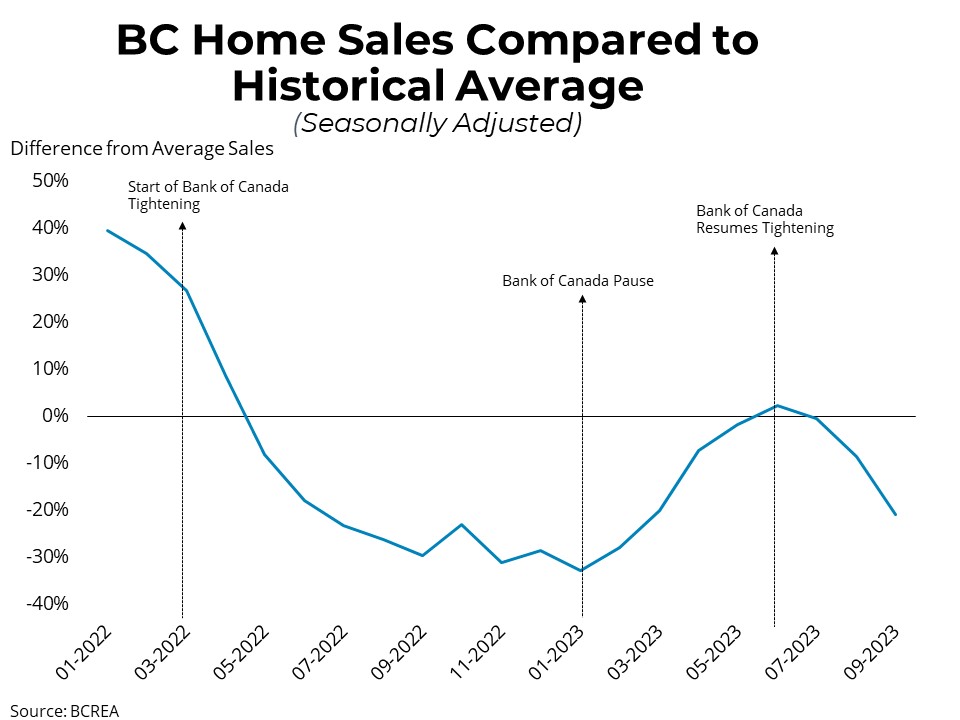

“Home sales in BC have clearly been impacted by the Bank of Canada's recent tightening of interest rates, along with the resulting surge in mortgage rates,” said BCREA Chief Economist Brendon Ogmundson. “Home sales are once again trending at below average levels as potential buyers struggle with a high cost of borrowing.”

Active listings in the province were up slightly month-over-month at just over 33,000 total listings and were 8.1 per cent higher year-over-year.

Year-to-date BC residential sales dollar volume was down 15 per cent to $57.9 billion, compared with the same period in 2022. Residential unit sales were down 11.5 per cent to 59,570 units, while the average MLS® residential price was down 4 per cent to $972,049.

To subscribe to receive BCREA publications such as this one, or to update your email address or current subscriptions, click here.

-

Markets at a Glance

Markets at a Glance -

Housing Market Update – July 2024

Housing Market Update – July 2024 -

Housing Monitor Dashboard

Housing Monitor Dashboard -

Mortgage Rate Forecast

Mortgage Rate Forecast