Though many licensees are not aware of it, in a phased strata project the developer must contribute to the cost of common facilities until the final phase is deposited. The British Columbia Court of Appeal's recent decision in Strata Plan NES 97 v. Timberline Developments Ltd. is a good illustration.1 In that case, a strata corporation in Fernie successfully sued the developer for roughly four years worth of unpaid contributions to certain expenses.

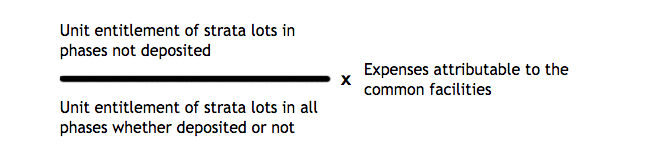

By developing in phases, a developer can add strata lots and common property over time. The Strata Property Act (Act) defines a common facility as a "major facility in a phased strata plan, including a laundry room, playground, swimming pool, recreation centre, clubhouse or tennis court, if the facility is available for the use of the owners."2 Pending the filing of the last phase, Section 227 of the Act requires the developer to share the expense of common facilities with the strata corporation. Subject to the regulations, this is the formula for sharing expenses:

In a phased project this divides the expense of common facilities between owners who purchase early in the development and the developer, where the developer serves as a proxy for those who will become owners in the future, after later phases are built.

In the Timberline case, the developer built the project in 11 phases. There were 175 strata lots in six buildings. There were also six hot tubs, each associated with a particular lodge. In addition, three of the lodges contained a common laundry room and four lodges had elevators. For several years, the owners paid all the expenses for the hot tubs, laundry rooms and elevators. The developer never contributed to these expenses.

Eventually, the strata corporation sued the developer, claiming that the hot tubs, laundry facilities and elevators were all common facilities and that the developer must reimburse the strata corporation for the developer's share of their expense. The strata corporation claimed reimbursement for a roughly four year period ending February 1, 2008, when the developer filed the final phase.

The critical question was whether the various features were common facilities within the meaning of the Strata Property Act.

The court confirmed that the hot tubs were common facilities and that the developer must reimburse the strata corporation for its share of their expense. The tubs were a major feature because they were important or significant to the facility and were available to all the owners. In particular, the hot tubs qualified as common facilities because they were optional features that enhanced the development's overall quality for the owners. The relevant expenses were attributable to the hot tubs for wear and tear over time, including the necessary replacement of one of the tubs, which was especially expensive.

For the same reasons, the laundry facilities qualified as common facilities within the meaning of the Strata Property Act. The court rejected the strata corporation's claim, however, because it could not prove that the particular expenses were clearly attributable to the laundry facilities.

Finally, the court found that the elevators were not common facilities because they were not optional. Instead, the elevators were a standard means of access, similar to a hallway or stairs.

In a development where the last phase is not yet filed, it is a good idea to ask if there are any common facilities, and if so, whether the developer contributes to their upkeep.

| 1. | Strata Plan NES 97 v. Timberline Developments Ltd., 2011 BCCA 421 aff'g 2010 BCSC 1811. | |

| 2. | Strata Property Act, s. 217 (definition of "common facility"). |

To subscribe to receive BCREA publications such as this one, or to update your email address or current subscriptions, click here.

Without limiting the Terms of Use applicable to your use of BCREA's website and the information contained thereon, the information contained in BCREA’s Legally Speaking publications is prepared by external third-party contributors and provided for general informational purposes only. The information in BCREA’s Legally Speaking publications should not be considered legal advice, and BCREA does not intend for it to amount to advice on which you should rely. You should not, in any circumstances, rely on the legal information without first consulting with your lawyer about its accuracy and applicability. BCREA makes no representation about and has no responsibility to you or any other person for the accuracy, reliability or timeliness of the information supplied by any external third-party contributors.

-

Landlords Take Notice – Recent Amendments to BC Tenancy Legislation #574

Landlords Take Notice – Recent Amendments to BC Tenancy Legislation #574 -

It’s Finally Here: The Short-Term Rental Accommodations Act #572

It’s Finally Here: The Short-Term Rental Accommodations Act #572 -

Listing and Selling Tenanted Properties #553

Listing and Selling Tenanted Properties #553 -

Prohibition on Rental and Age Restrictions in Strata Buildings #556

Prohibition on Rental and Age Restrictions in Strata Buildings #556